Written by Steve Andrews

Festive Market Trends

As we edge into a New Year, the markets have embraced the holiday spirit with the S&P 500 currently enjoying its longest string of weekly gains since 2019. The bond market is rallying as well, driving the yield on the 10-year Treasury down below 4.00% from its recent high of just over 5.00% in late October. Investors have been heartened by what they perceive as the end of the “Fed Led” era. It was almost two years ago when the Fed, shaken by its misreading of the inflationary trends that were pushing prices for goods and services up in nearly double-digit increments, embarked on the sharpest rate hiking program since 1994. Once in motion, the aggressive Fed policy terrified investors who believed that the Fed, in its quest to stifle inflation, would drive the US economy into a recession.

While the Fed did its darndest, the US economy proved to be more resilient than even the most optimistic investors expected. A lot of that credit should go to the US consumer who we believe (apologies to Taylor Swift) deserves to be honored as the “Person of the Year,” with spending on services up 6.8% over the past year.

Interest Rate Outlook

As the calendar turned to November, the markets made it clear that investors are getting more comfortable with the notion that the Fed is done raising rates. The late summer slump in stocks really dampened consumer optimism over the past few months but the recent rebound in US stocks has not gone unnoticed by consumers. The early December report on consumer sentiment from the University of Michigan rebounded to a four-month high, beating all forecasts, as consumers are once again feeling better about their personal finances. In addition, consumers’ outlook for inflation over the next year fell to its lowest level (3.1%) since 2021, from 4.5% in the previous survey.

That sentiment has been echoed by some of the more hawkish (rate hiking) members of the FOMC. One, noted Fed hawk Christopher Waller, surprised many at a recent Washington conference by saying that “I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2 percent.” While cautioning that there is still work to be done, he conceded that “we have seen the most rapid decline in inflation on record.” Fed Chair Jerome Powell has said repeatedly that the Fed won’t hesitate to tighten US monetary policy further, if needed to contain inflation, but it seems to us that the Fed is repeating the same mantra – not wanting to give the impression that they are satisfied with current rates of inflation.

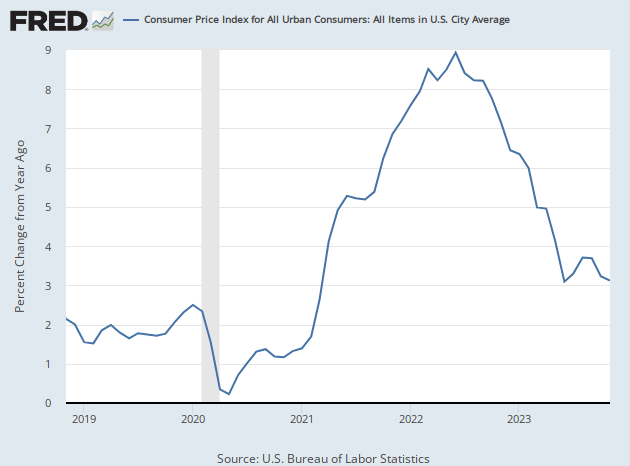

Consumer Price Index (CPI) Trends

Yet disinflation continues. The just-released CPI data for November shows that consumer prices rose 0.1% from October and were up 3.1% from a year ago, while “Core” CPI, which excludes volatile food and energy costs, rose 4.0% from a year ago – the smallest increase since September 2021. Meanwhile, Producer Prices (PPI) were flat in November and PPI was up just 0.9% from a year ago, compared with the 1.3% year-over-year increase in October.

Consumer Resilience & Labor Market Dynamics

Consumer spending has remained steady despite the wide ebbs and flows in consumer sentiment. Retail sales rose 0.3% in November, lifting them 4.1% above year-ago levels. As has been the case for most of the year, spending on services continued to rise at the expense of goods, with sales at restaurants and bars up 13.3% over the past year. Employment continues to feed consumer spending. While US nonfarm payrolls rose 199,000 in November, the Household Survey, of smaller businesses and start-ups, from which the unemployment rate is calculated, showed a gain of 747,000 jobs. The US labor force rose 532,000 last month and this rise in the household survey pulled the unemployment rate down to 3.7%. The US Labor Force Participation Rate (the percentage of the working age population in the labor force) rose to 62.8% last month, from 62.7% in October and the share of the population over the age of 16 that are employed rose to 60.5% - the highest percentage since COVID first hit in February 2020.

The US economy heads into the New Year in much better spirits than a year ago when most felt that a recession was imminent. While the economy will undoubtedly slow from Q3’s muscular 5.2% GDP growth to something closer to 2.0% next year, that slower growth, along with continuing disinflation, will give the Fed the leeway to begin to ease rates lower. At the recent December meeting, the FOMC members updated their projections for the Fed Funds rates next year to include three 0.25% rate cuts compared with one 0.25% rate hike and two 0.25% rate cuts projected at the September FOMC meeting. In response, the yield on the 10-year Treasury has dipped below 4.00% for the first time since July, pulling the average 30-year FHLMC mortgage rate below 7.00%.

Market Response and Future Considerations

Stocks, too, are enjoying the prospects for a ”softer” Fed, with the Dow reaching a record high at mid-month, since the Fed acted as The Grinch in the eyes of investors for the better part of the last 12 months. We have believed for some time that, once the markets sensed that the Fed was done tightening monetary policy, we would see investors’ spirits rise, but the turnaround has been even faster than we expected. There will still be bumps in the road ahead as just when and how much the Fed will lower rates becomes the focus. No matter. The drivers of the recent rebound remain a force. Inflation and economic growth will continue to moderate, and it was this combination which kept the Fed on the sidelines for the better part of a decade from 2009 – 2019 and ushered in the longest (albeit tepid) economic expansion in modern history.